Frequently Asked Questions

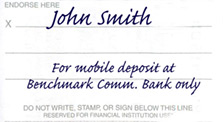

IMPORTANT: Mobile deposit users agree to restrictively endorse any item transmitted through the service as instructed by the bank.

All checks presented to Benchmark Community Bank via mobile deposit must be endorsed as follows:

Your name as shown on the front of the check

"For mobile deposit at Benchmark Comm. Bank only"

If the check you are depositing includes the endorsement check box "For mobile deposit," you may check the box and add:

Your name as shown on the front of the check

"Benchmark only" or

"Benchmark Bank only" or

"Benchmark Comm. Bank only."

If the check you are depositing does not have the "For Mobile Deposit" check box, you will need to include the full phrase as indicated above in the first example.

Q: Can I deposit any type of check via BCB Mobile Deposit?

A: Each check will be reviewed for acceptance and must be payable to the account owner who is depositing the item. We reserve the right to reject mobile deposits at which time you will be notified of the reason for rejection.

After accepting the terms and conditions for using BCB Mobile Deposit, you agree to NOT scan and deposit any of the following types of checks which we consider to be ineligible items:

- Checks payable to any person or entity other than the person or entity that owns the account that the check is being deposited into.

- Checks containing an alteration on the front of the check or item, or which you know or suspect, or should know or suspect, are fraudulent or otherwise not authorized by the owner of the account on which the check is drawn.

- Checks previously converted to a substitute check, as defined in Reg. CC.

- Checks drawn on a financial institution located outside the United States.

- Checks that are remotely created checks, as defined in Reg. CC.

- Checks not payable in United States currency.

- Checks dated more than 6 months prior to the date of deposit.

- Insurance checks, money orders, traveler’s cheques, or savings bonds.

- Checks payable on sight or payable through Drafts, as defined in Reg. CC.

- Checks with any endorsement on the back other than that specified in the terms and conditions.

- Checks that have previously been submitted through BCB Mobile Deposit or through a remote deposit capture service offered at any other financial institution.

- Checks or items that are drawn or otherwise issued by the U.S. Treasury Department.

Official checks may be deposited by business customers into a business account.

Q: Are there any limits on the checks I deposit through BCB Mobile Deposit?

A: The deposit limits are:

- $999.99 maximum limit per check

- $2,000.00 maximum limit deposited per day

- $5,000.00 maximum limit deposited per 30 days

- Number of mobile deposits - unlimited

Q: How does the bank receive my check?

A: The bank only requires the images of the front and back of the check that you take with the camera on your mobile device. The original check stays in your possession.

Q: What do I do with the check once it has been submitted for deposit?

A: Write "Void" on the check and keep it in a safe place for 45 days AFTER the deposit amount has been posted to your account.

Q: Can I delete a deposit once it has been submitted?

A: No, once your deposit has been submitted, it is automatically sent to the bank for review. Contact your local branch for further assistance.

Q: How do I know that my check has been accepted through BCB Mobile Deposit?

A: Once your check has been successfully submitted, you will get a confirmation on your screen. This notice only confirms that your deposit was submitted. Once your deposit has been reviewed, you will receive an e-mail from the bank stating that your check was ACCEPTED, ADJUSTED, OR DELETED.

You can view the status of the deposit within our mobile app by selecting Check Deposit and clicking the History tab. The last 60 days of deposits will display.

Q: Can I see the "pending deposit" within Internet Banking once I have sent the deposit?

A: No, checks submitted through BCB Mobile Deposit do not reflect within Internet Banking until the deposit posts to your account on the next business day.

Q: Why was my mobile deposit adjusted?

A: Your mobile deposit will be adjusted if the dollar amount that you submitted is incorrect. A bank administrator, who reviewed your check for deposit, corrected the amount of the deposit.

Q: Why was my mobile deposit deleted?

A: Your mobile deposit can be deleted for numerous reasons. You will receive an e-mail stating the reason.

Q: If my check deposit gets deleted by the bank, how do I negotiate it?

A: If your check was deleted due to an incorrect endorsement, it can be corrected and re-submitted through BCB Mobile Deposit. For all other reasons, the check will need to be presented for deposit at a branch.

Please note: If your use of BCB Mobile Deposit consists of any unauthorized or illegal purposes of you use the service in a manner in which we believe to be with fraudulent intent, we may remove you from the service.

For all other questions, contact your local branch and ask to speak with an e-Services specialist.

Standard data rates and fees may apply from your wireless carrier.